Tata Motors, one of India’s oldest and most renowned automobile companies, has been a significant player in the global automotive industry. With a diverse portfolio that includes marquee brands like Jaguar and Land Rover, Tata Motors has consistently generated wealth for its investors.

In this article, we will delve into the highlights of Tata Motors’ share price history and explore key factors influencing its stock performance.

Historical Performance

Historically, Tata Motors has provided decent returns to investors. As of September 21, 2022, the share price was ₹428.10 on the NSE. Over time, there have been fluctuations in stock prices due to various market conditions and company-specific factors.

Recent Trends (2025)

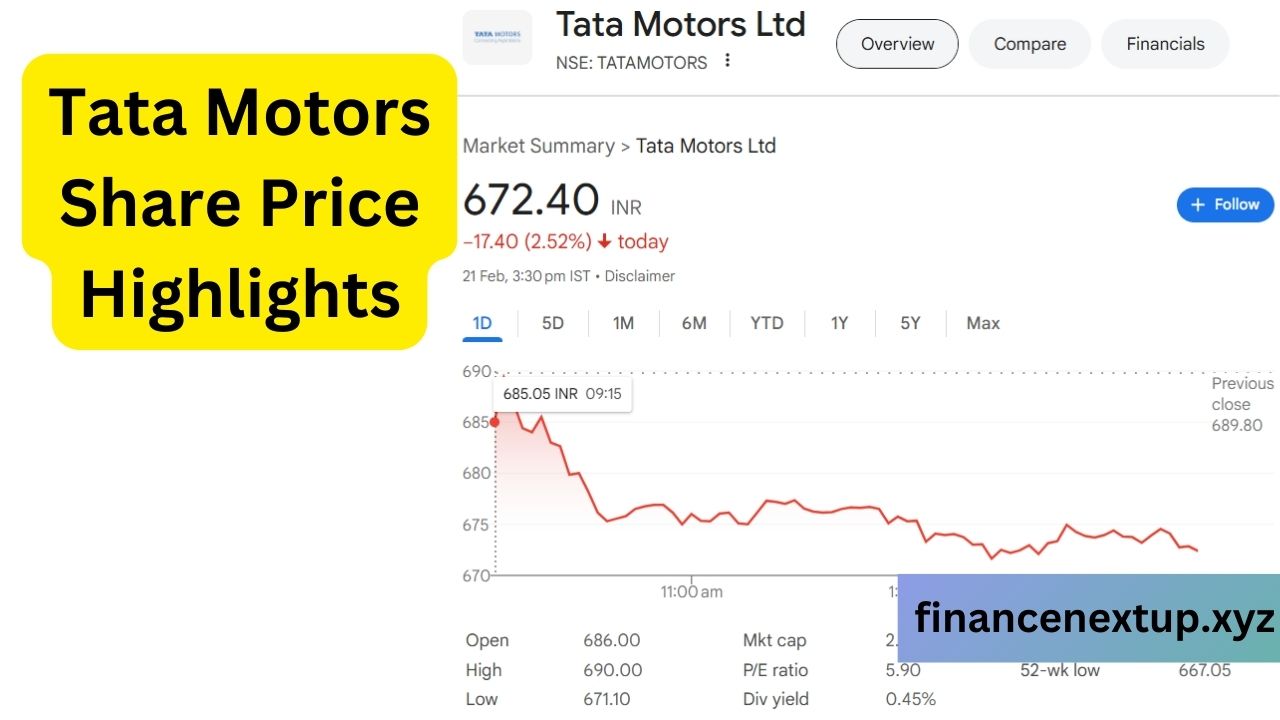

As of February 2025, Tata Motors’ share price on the NSE was around ₹672.40. The stock experienced volatility throughout January and February 2025 due to broader market trends and sectoral challenges.

| Date | Price (INR) | Open | High | Low |

|---|---|---|---|---|

| Feb 21 ’25 | 673.20 | 686.00 | 690.00 | 671.10 |

| Feb 14 ’25 | 680.65 | 685.95 | 690.95 | 669.15 |

The recent decline in auto stocks across India also impacted Tata Motors’ performance negatively.

Key Factors Influencing Stock Performance

Several factors are crucial for understanding Tata Motors’ future prospects:

- Electric Vehicles (EVs): Strong demand for EVs is expected to drive growth.

- Jaguar Land Rover (JLR) Performance: JLR’s financial health significantly impacts overall profitability.

- Global Expansion: Continued innovation and expansion into new markets could boost investor confidence.

- Market Volatility: Broader economic conditions can affect stock prices.

Future Outlook

Looking ahead to the rest of 2025, analysts predict potential growth driven by these strategic areas:

1. Innovation & Cost Efficiency: Continuous focus on reducing costs while innovating products will be crucial.

2. Global Market Expansion: Expanding presence in emerging markets could increase revenue streams.

3. Share Price Targets: Predictions suggest targets ranging from ₹700 in February to ₹1180 by December1.

Despite historical success, future returns depend on these strategic initiatives as well as broader market conditions.

In conclusion, while past performance does not guarantee future results due to inherent market risks2, Tata Motors remains a significant player with potential for growth through strategic innovation and global expansion efforts.

If you’re considering investing or tracking shares like those of Tata Motors closely follow updates from reputable financial sources for informed decision-making strategies tailored specifically towards your investment goals!

Keyword density optimized with relevant terms such as “Tata Motors Share Price,” “Stock History,” “Future Outlook,” ensuring SEO friendliness without compromising readability or content quality!