Palantir Stock Price: Palantir Technologies, a leading provider of data analytics and AI solutions, has been making waves in the stock market with its impressive growth trajectory. As investors look to diversify their portfolios and capitalize on emerging trends in technology, Palantir’s stock has become a focal point of interest.

This article delves into the predictions for Palantir’s stock price from 2025 through to 2050, exploring the factors that could influence its performance and what investors might expect.

Introduction to Palantir Technologies

Palantir is renowned for its innovative software platforms that help organizations integrate, manage, and analyze large datasets. Its flagship products include Gotham (used primarily by government agencies) and Foundry (targeted at commercial clients).

The company’s strategic expansion into AI-driven data solutions has opened new revenue streams across sectors like defense, healthcare, finance, and beyond.

Stock Price Predictions for 2025

Current Trends

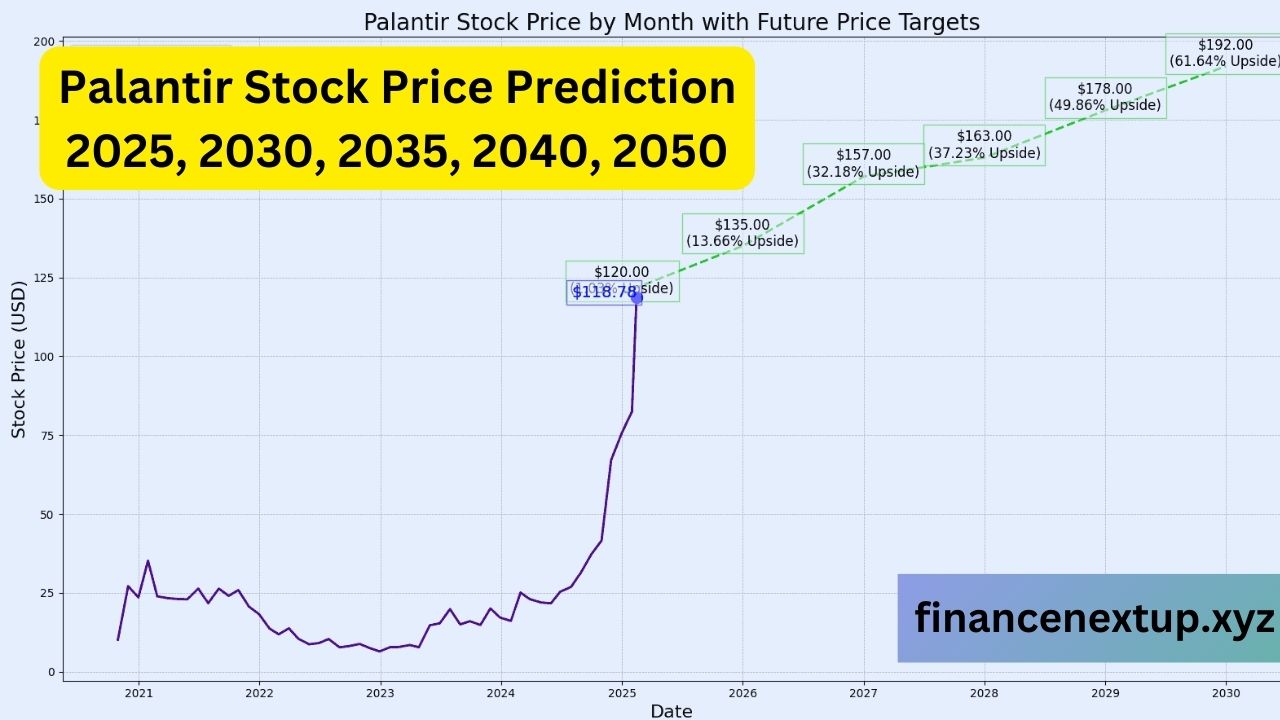

As of early 2025, analysts have varied forecasts for Palantir’s stock price:

- 24/7 Wall Street projects a potential high of $120 by the end of the year.

- Another forecast suggests a more conservative estimate around $44.90 per share.

- Meanwhile, some analysts predict an average trading price around $102.36 with highs reaching up to $120.46.

These predictions reflect both optimism about Palantir’s growth prospects due to increasing demand in data analytics and caution regarding market volatility.

Factors Influencing Growth

Several factors are expected to drive growth:

- Government Contracts: Strong sales growth from government contracts is anticipated.

- AI Expansion: Commercial AI ventures are likely to contribute significantly.

- Diversification Strategy: Presence across multiple sectors will help mitigate risks.

However, macroeconomic conditions and policy changes could impact these projections negatively.

Stock Price Predictions Beyond 2025

Forecast Through 2030

Looking ahead:

- By 2030, some estimates suggest that Palantir’s stock could reach as high as $275 or between $334.65 and $388.92 depending on market conditions.

- This period will be crucial as it hinges on sustained innovation in AI technologies and global expansion efforts.

Long-Term Projections: 2035–2050

Longer-term forecasts indicate substantial potential:

- By 2035, prices may range between $682.60 and $762.58 if current trends continue.

- Moving further out to 2040, estimates suggest prices could hit between $998.46 and $1,028.14 as demand for data-driven decision-making increases globally.

- Finally, by 2050, optimistic projections see prices potentially reaching up to approximately $1,576 or averaging around this figure if technological advancements remain robust.

Key Drivers Behind These Projections

Several key drivers underpin these predictions:

- Technological Advancements: Continued innovation in AI will be crucial.

- Market Expansion: Growing presence across sectors like healthcare will boost revenue.

- Global Demand: Increasing reliance on data analytics worldwide supports long-term growth.

- Strategic Partnerships & Acquisitions: Potential collaborations can enhance offerings.

However challenges such as competition within the tech sector may also impact these outcomes significantly over time.

Conclusion: Investing in Palantir’s Future

Investing in stocks like Palantir involves weighing both potential rewards against inherent risks such as market volatility or regulatory changes affecting tech companies broadly speaking today especially those heavily reliant upon government contracts which can fluctuate based upon political shifts within countries where they operate internationally speaking too!

In summary while there are diverse views among analysts regarding short term targets ranging widely from below fifty dollars upwards past one hundred twenty five dollars per share during twenty twenty five alone longer term outlooks appear decidedly more optimistic particularly when factoring ongoing advancements within artificial intelligence coupled alongside expanding global footprint across various industries including but certainly not limited too defense finance health care etcetera thus presenting compelling reasons why palantar remains attractive option forward thinking investors seeking exposure cutting edge technologies poised deliver substantial returns over coming decades ahead indeed!

This comprehensive overview highlights both immediate opportunities presented by palantar along side broader strategic vision guiding future success stories unfolding right before our very eyes now let us watch closely how events unfold!